How to Name Minor Children as Life Insurance Beneficiaries

Do you want to ensure your minor children receive your life insurance proceeds if you die while they are young? Not confident about what to put on that beneficiary designation form? Technically, you have five options to consider. But in reality, only three of them function in ways that make sense when thinking about what your children will need if you’ve died and they are still young.

If you have a Will with a Testamentary Trust, name the Testamentary Trust's Trustee as the beneficiary. Two considerations:

The appropriate way to word the beneficiary designation is specific to your Will/Testamentary Trust (a generic phrase may not work); and

You should update the beneficiary information when the children have "aged out" of the Testamentary Trust termination age (and you're still alive).

If you have a Revocable Living Trust - name the Trustee as the beneficiary. Two considerations:

The appropriate way to word the beneficiary designation is specific to your Trust (a generic phrase may not work); and

You should update the beneficiary information when the children have "aged out" of any applicable trust termination age (and you're still alive).

Use the Uniform Transfers to Minors Act (UTMA) by explicitly invoking the Act. Example:

Elliott Smith as custodian for my child Kennedy, under the NC UTMA until Kennedy reaches age 18.

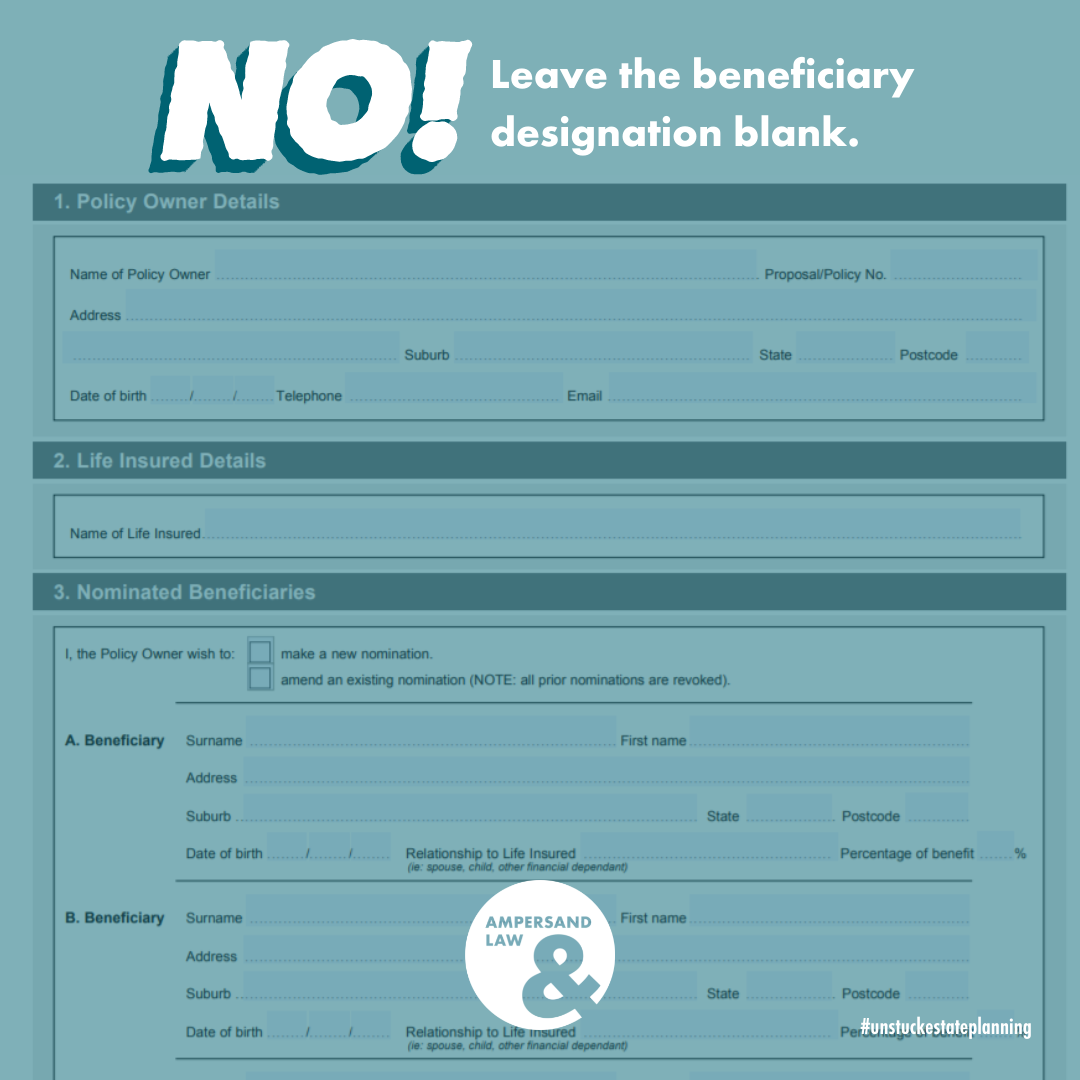

Leave the beneficiary designation blank. Unless your policy states otherwise, the proceeds will pay to your estate and be part of your probate/estate court case.

This option changes life insurance proceeds by making them subject to the probate/court process, including the fees set based on the estate value. An estate valued at $100,000 is subject to $400.00 of value-based fees plus filing fees. An estate valued at $1,100,000 (including life insurance proceeds) is subject to $4,400.00 of value-based fees plus filing fees.

This option can create unanticipated tax consequences if the estate is open for a full tax period+.

If you have a Will, the proceeds distribute according to the terms of your Will.

If you don't have a Will, your estate is subject to the intestacy statutes. Distributions go to those specified by state law, with no exceptions.

Name the minor child directly. If you die before your child is 18 and the life insurance proceeds will pay to them, one of two things happens, and neither of them is easy nor fast:

The Clerk of Court holds the funds, and the court acts as guardian of the assets until the child turns 18 and then distributes them in a lump sum to the (now adult) child. Additional restrictions may apply based on state law and local court rules.

Someone applies to be "Guardian of the Estate" on behalf of the child and, if approved, may access the funds for the child's benefit. The Guardian is required to post an insurance bond to protect the funds. The court remains involved, supervising the Guardian and the use of funds under a very rigid set of parameters. These process/requirements apply to anyone applying to be Guardian, even if they are the child's other legal parent or close relative.

For most people, one of the first three options is a close match to what they envision happening in this hard-to-think-about scenario. Working with an estate planning attorney provides additional certainty.

On the other hand, options four and five will needlessly complicate things for your children and those caring for them. And options four and five will create otherwise unnecessary delays in accessing funds and additional costs/fees (taking more money away from your children).

Want more information? Speak with your life insurance company. For more information on how to ensure estate plan is set up in a way that allows your children to benefit from your life instances, contact me (or another estate planning attorney).